News

Featured Articles

Added on April 30, 2024 by T. Powell to Member News

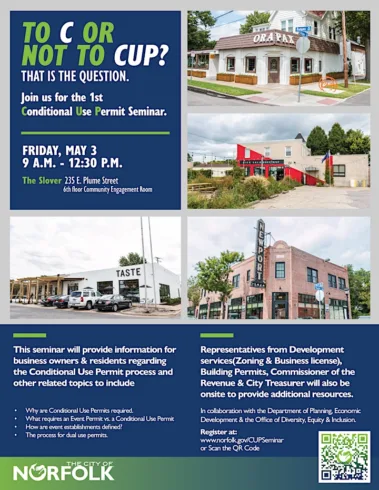

Join us for the 1st Conditional Use Permit Seminar!

Read More

Added on April 30, 2024 by TWO MEN AND A TRUCK to Member News

Movers for Moms – Help Mothers in Need This Mother’s Day

Read More

Added on April 29, 2024 by Dan Hankin to Member News

MARKET HEIGHTS APARTMENTS RECOGNIZED WITH 2024 COSTAR IMPACT AWARD

Read More

Added on April 29, 2024 by Laura Devore to Member News

40th Annual Stockley Gardens Spring Arts Festival on May 18 and 19

Read More

Added on April 29, 2024 by Kevin Gaydosh to Member News

Chartway holds grand reopening of its first bilingual branch in Virginia

Read More

Added on April 24, 2024 by Nicole Ingalls to Member News

Veterans United Home Loans Amphitheater at Virginia Beach May Day Premium Seats Open House

Read More

Added on April 24, 2024 by Chloe Josephs to Member News

Cooper Hurley Injury Lawyers is donating Fifteen Thousand to Local Non-Profits Nominated by Hampton Roads Residents

Read More

Added on April 24, 2024 by Dan Hankin to Member News